Overcoming Guilt From Financial Mistakes’ I’d just made smarter choices earlier, I wouldn’t be in this mess now.” so how can we help

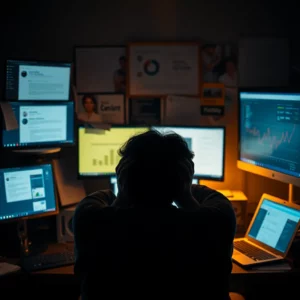

If that thought has been swirling in your mind lately, you’re not alone. Financial regret is a heavy weight. It feels like carrying an invisible backpack full of stones, each one etched with a decision you wish you’d made differently. Maybe it was overspending in your 30s, trusting the wrong investment advice, or just not saving as much as you planned. Whatever the reason, guilt has a way of whispering in your ear, reminding you of what you could’ve done better.

But here’s the truth: living in regret won’t change the past. What it can do, though, is stall your future.

What Is Financial Guilt and Why Does It Hurt So Much?

Regret doesn’t always scream; sometimes, it’s a quiet but constant presence. It shows up in the checkout line when you’re second-guessing your purchases. It sneaks into conversations when someone mentions retirement planning. And it’s there at night when you lie awake wondering if you’ll ever feel secure again.

Financial guilt strikes deeply because money represents more than transactions—it’s tied to security, opportunity, and even self-worth. When you feel like you’ve mishandled it, it’s easy to equate that with personal failure.

The truth? You’re human. Everyone makes choices based on what they know at the time, and hindsight is always clearer than foresight.

How to Turn Financial Mistakes Into Growth Opportunities

Imagine you’re holding a magnifying glass. If you use it to focus on the past, you’ll see every little misstep blown out of proportion. But what if you turned that lens toward your future? Instead of analyzing what went wrong, you could start asking what’s possible now.

Every mistake carries a lesson, and that lesson can be the foundation for a stronger financial future. The next time guilt strikes, ask yourself:

- What did I learn from this experience?

- How can I apply that knowledge moving forward?

- What small step can I take today to improve my finances?

Practical Steps to Move Past Financial Regret

Breaking free from the cycle of guilt starts with action. Even small steps can help you regain confidence and control over your financial future. Here are three strategies to get started:

- Reframe Your Thoughts

Instead of thinking, “I failed,” tell yourself, “I learned.” This simple change in language transforms how you see yourself—from someone who’s stuck to someone who’s growing. - Set Small, Achievable Goals

You don’t need to overhaul your finances overnight. Focus on one realistic goal, like saving an extra $50 this month or cutting back on a single expense. - Practice Self-Forgiveness

Forgiving yourself doesn’t mean excusing past mistakes. It means freeing yourself from their emotional grip so you can move forward.

Why Affiliate Marketing Is a Great Option for a Fresh Start

When it comes to rebuilding your finances, you don’t have to go it alone or start from scratch. Affiliate marketing is an opportunity to create a new income stream without the need for large upfront investments.

Affiliate marketing allows you to earn money by promoting products or services you believe in. You don’t need advanced technical skills or a hefty budget to get started. Instead, it’s about leveraging your unique voice and perspective to build something sustainable.

How Michael Cheney Can Help You Succeed

Navigating affiliate marketing on your own can feel daunting, especially if you’re still carrying the weight of financial guilt. That’s where Michael Cheney comes in. His Millionaire’s Apprentice program is a step-by-step guide designed to help people like you take control of their financial future.

Michael’s program doesn’t just teach you affiliate marketing—it gives you the tools, support, and confidence to succeed. With his guidance, you’ll learn how to rebuild not only your finances but also your belief in yourself.

Take Control of Your Financial Future Today

You can’t change the decisions you made in the past, but you can decide what to do next. Imagine looking back a year from now and seeing how far you’ve come—not in spite of your financial mistakes but because of them.

Your past doesn’t define you. It informs you, equips you, and ultimately strengthens you. That invisible backpack of stones? It gets lighter with every step you take forward.

So here’s the question: What will you do today to start your journey? If you’re ready to turn guilt into growth, Michael Cheney’s Millionaire’s Apprentice program is here to guide you every step of the way.

You’ve carried the weight of regret long enough. Now it’s time to carry something else: hope.

Overcoming Guilt From Financial Mistakes by Peter Hanley

The slow climb back, why rebuilding savings can seem so hard

I would love to try affiliate marketing but what if it doesn’t work